Welcome to our in-depth analysis of Orbex, initially published in January 2023 and most recently updated April 23rd, 2023. Make sure to check out our mission statement and why we do what we do. Look at our New Space guide if you want explanations of terms and concepts used in our research. And follow us on Twitter for updates.

What you should know about Orbex

📰 For space enthusiasts

- Developing the Prime Rocket, a micro launcher vehicle with 180 kg LEO payload capability, 150 kg SSO

- First launch planned 2023/2024 from Space Hub Sutherland in Scotland

- Two-stage rocket with 6 first stage, one second stage LOX / bioLPG engine with 30 kN of thrust

- Engine development in Copenhagen, many of the leading engineers from Copenhagen Suborbitals

💰 For VCs and industry experts

- UK’s best funded new space rocket company with over GBP 75 million in funding

- VCs and government investment from UK, Denmark, Germany

- Post money valuation of GBP 160 million in 2022 Series C

- No more than 12 launches per year at microlauncher class planned

- Manager and operator of Sutherland spaceport

👨💻 For potential employees

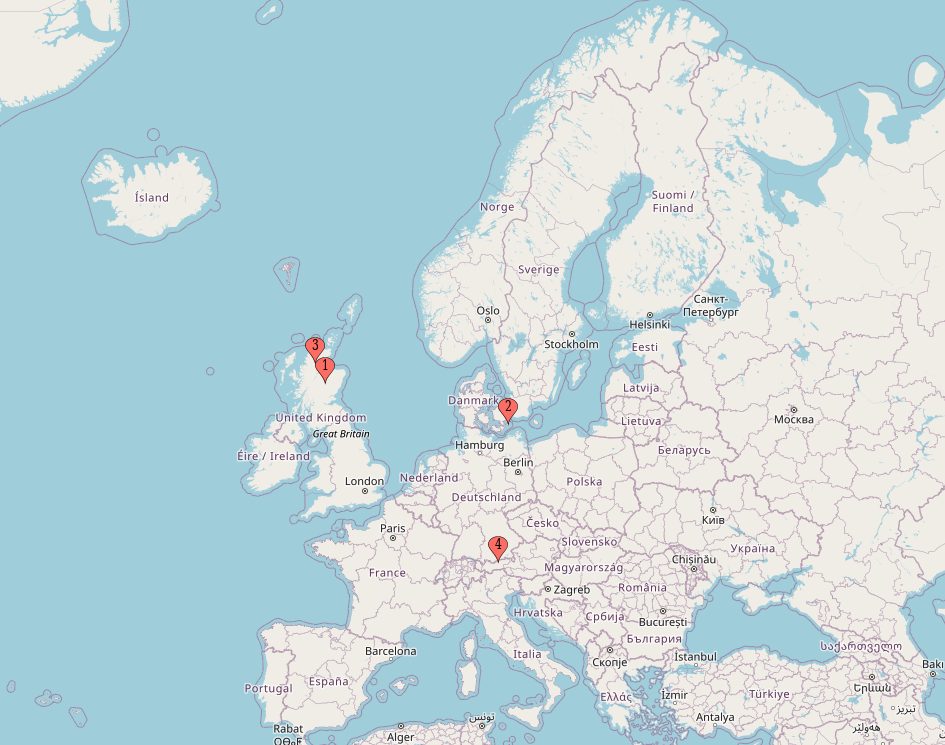

- Fast-growing rocket launch company with offices in UK (Scotland) and EU (Denmark)

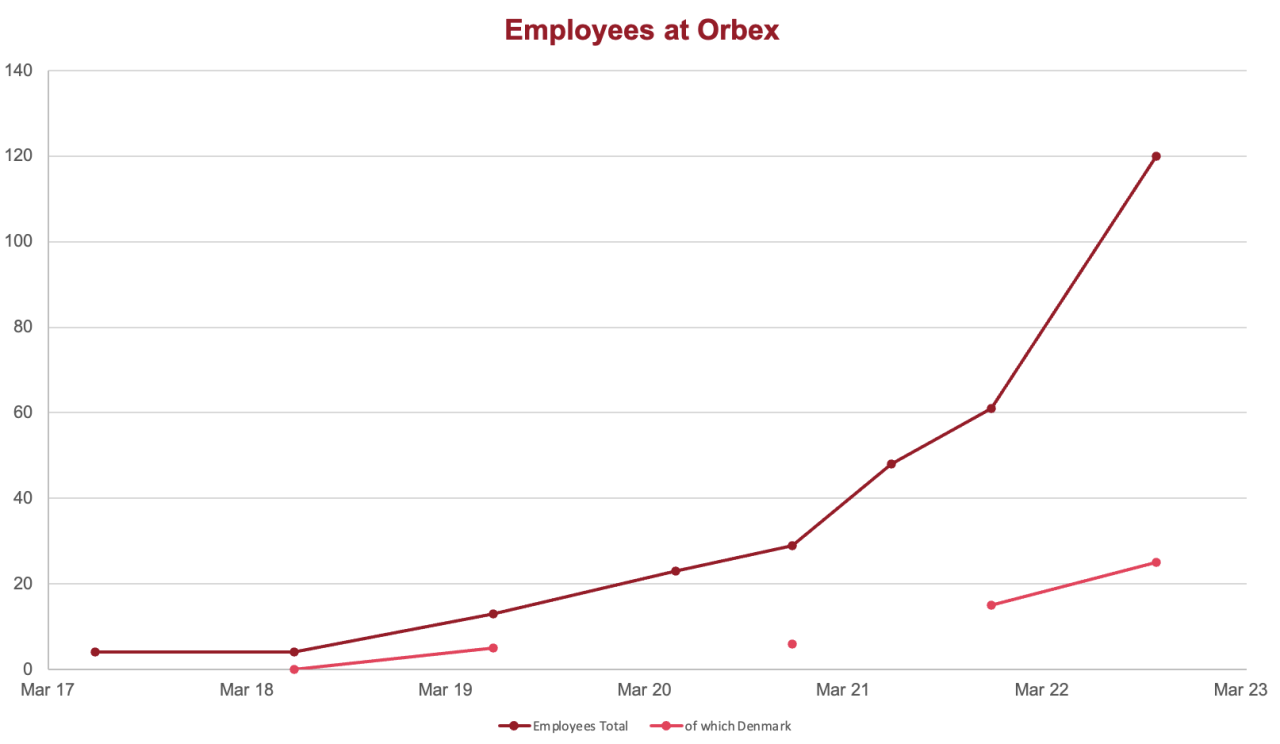

- 120+ employees, of which around 80% are in the UK office.

- Copenhagen office focussed on engine and propulsion development, UK on manufacturing, test and launch operations

- Salary between GBP 42,000 – GBP 75,000 for engineers in Denmark (propulsion), GBP 43,000 – GBP 66,000 for engineers in UK (electronics, test). Business ops between GBP 25,000 – GBP 45,000

Orbex: The story of one of UK’s largest new space companies

Orbex is a European rocket startup developing the Orbex Prime rocket. The Orbex Prime will be a microlauncher with potential payloads of up to 150 kilogram to low earth orbit (LEO). Orbex, officially Orbital Express, was founded in 2015 by Chris Larmour and Kristian von Bengtson.

Orbex is truly a European new-space startup, though it considers itself UK-based for strategic reasons. Nevertheless, core rocket development is done in the Danish Orbex office, which is led by several former Copenhagen Suborbital volunteers. Orbex is not just a potential future launch provider, it was also chosen as manager and operator of the Sutherland spaceport in northern Scotland. As such, Orbex is uniquely positioned as it plans to provide dedicated orbits from a dedicated launch site.

Having raised over GBP 75 million, Orbex is certainly one of the larger potential launch providers in Europe. We’ll show you what Orbex plans, what they do well, and what they don’t so well.

From Moonspike to Orbital Express – Orbex’s interesting founding story

“We’re building a moon rocket!”. Those were the words of Christopher Larmour, founder and CEO of Orbital Express. It all started in 2015 when Larmour, while browsing reddit, saw high altitude balloon launches and wondered whether it is possible to send a rocket to the moon – and why it hasn’t been done before in Europe. After a few days of research, he emailed Copenhagen Suborbitals and got in touch with Kristian von Bengtson. The two of them worked together and produced a plan, called “Moonspike”, on how the audacious goal could be achieved.

So how did Orbex become a relevant player in the newspace economy?

Moonspike did not take off – at least not literally. It did however fuel both Larmour’s and Bengtson’s ambitions and brought together three key pieces for Orbex. A bit of background:

- Christopher Larmour, UK national living in Munich. Larmour has a technical communications background, started his career in corporates such as Siemens and later moved into more marketing and business oriented positions at small scale tech companies before starting Orbex (or rather: Moonspike) in 2015.

- Kristian Bengston: Bengtson, a Danish national, with a passion for anything technical. Bengtson founded Copenhagen Suborbitals, an amateur and open-source space program. Through Copenhagen Suborbitals, Bengtson has a track record of small but successful amateur rocket launches. He was also a contributor to the failed Mars One project, and thus inclined to audacious projects in space.

- Moonspike: Larmour spontaneously contacts Copenhagen Suborbitals to inquire about a rocket launch to the Moon. He meets Bengtson and the two get along. After around 9 months of work, they launch a kickstarter called “Moonspike”, a mission to get a rocket to the Moon.

2016 – 2018: Orbex gains traction and jumps on the UK Space bandwagon

Though the Moonspike kickstarter campaign was unsuccessful, the approach provided enough boost for Larmour to keep going and turn Moonspike into Orbital Express Launch Limited. Key design changes for the rocket, financial support from business angels, a grant from the EU and closing a small seed round from HTGF (High-Tech Gründerfonds, a German venture capital (VC) firm) in 2017, “Orbex” becomes real.

In what turned out to be great timing, Orbex was in the perfect position to jump on the “UK Space bandwagon”. In February 2017, the UK launched its Launch UK Prospectus and publishes its open call for the space program. Orbex applies with the following key factors in place:

- Orbex came with enough PR and traction through Moonspike, making Larmour comfortable in the environment,

- they secured business angel (ca. GBP 100,000) and seed funding (ca. GBP 150,000 – GBP 400,000),

- they had several Copenhagen Suborbitals volunteers’ track record (“our team has flown rockets, has worked at NASA and ESA”),

- was in proximity to another contender for the UKSA’s grants: Sutherland spaceport and

- added just the right tidbits to make the ESG-crowd happy, in particular its low carbon propellant.

With a team of less than 15 employees, this was enough to convince the UKSA to grant them GBP 5.5 million in funding in July 2018. Larmour, striking the iron while it’s hot, closed their Series A at the end of 2018. Key partners: Heartcore Capital, a Danish VC, a follow-up investment by HTGF and now Elecnor Deimos S.A., the Spanish aerospace corporate. Elecnor took the role of a strategic partner with Orbex by promising to provide GNC (guidance, navigation and control) infrastructure and technical support.

2019 – 2021: Progress on the business side, less so publicly for the rocket

Having secured roughly GBP 10 million in cash in 2018, Orbex now begins to build up infrastructure. Though still very small, it was suddenly a prime contender for the UK’s space strategy, being named alongside Lockheed Martin and the Sutherland spaceport. To manifest their connection with Sutherland, Orbex opens its first UK office in Forres, Scotland (up until this point, Orbex UK appears to have been mostly operating out of a business centre).

In the years 2019 to 2021, progress at Orbex seems to have been slow and steady. On the business side, Larmour began signing contracts with potential launch partners. They secured more funding, including public and private money, and began signing commercial contracts with SSTL, In-Space Missions or TriSept corporation.

The initial launch – planned for 2021 – was pushed back indefinitely. Records show that the Danish Orbex office, responsible for engine and propulsion development, was still only employing a handful of people, while the UK facility, responsible for handling structure and test operations, was growing steadily.

2022 to today: More funding, partners and now also a dedicated spaceport

Orbex closed a Series B in December 2020 of roughly GBP 11 million in equity, which included new venture capital firms such as BGF Investments or Octopus Titan. Existing investors such as Heartcore Capital and HTGF dragged along, while Elecnor did not invest further cash. At the end of 2020, Lockheed left the Sutherland spaceport for SaxaVord, leaving Orbex as the only contender for a launch from the Scottish spaceport. The new funding was now used to grow the company, more so in the UK than in Denmark, and the team approached 100 employees.

Orbex’s full stack Orbex Prime reveal in May 2022

In 2022, Orbex was once again in the right place at the right time and with the right people: Already in 2018, Larmour hired Catriona Francis, now Chief of Staff at Orbex. Francis was working at the UK Space Agency’s grant office up until 2018, before joining Orbex. Francis has also held positions at Jacobs, a multinational conglomerate and one of the key subcontractors for NASA’s Cape Canaveral.

With this setup of relationships, political and financial capital and helping the Scottish government develop the space cluster strategy, Orbex leverages its position and connections with Jacobs and the Highlands and Islands Enterprise (HIE) – who is behind Sutherland – and takes over the managerial and operational responsibility of the spaceport Sutherland in November 2022. At the same time, they close their Series C of almost GBP 40 million. Orbex now has the keys to the spaceport, is in prime position for Scotland’s space program and can subcontract its work to an experienced strategic partner: Jacobs.

So what about their rocket?

Orbex Prime: The microlauncher rocket from Orbex

Orbex is developing the Orbex Prime vehicle. The Prime rocket is a two-stage rocket with a height of 19 meters and a diameter of 1.3 meters. It will have a liftoff mass of 18 tons with a maximum payload capacity of 180 kilograms to low earth orbit (LEO) or 150 kilograms to sun-synchronous orbit (SSO). This makes the Orbex Prime one of the smallest orbital rockets in development.

Orbex is using LOX / bioLPG for propellants on both stages. The first stage (fed by turbopumps) will have 6 engines and the second stage one engine (pressure-fed). Orbex has been focusing on the development of a 6,750-pounds-force (30 kN) engine that uses propane (biopropane) as the core fuel. One key aspect of biopropane is that it remains liquid at cryogenic temperatures. This enables a “coaxial tank” design for the Prime launcher, where a central tube of propane is surrounded by an outer tank of liquid oxygen, creating structural mass savings in the rocket.

| Info | Orbex Prime |

|---|---|

| Height | 19 m |

| Diameter | 1.3 m |

| Gross Lift-off Weight | 18 t |

| Payload Capacity | 180 kg (LEO) 150 kg (SSO) |

| Number of Stages | 2 |

| Engines | 6 + 1 |

| Oxidizer / Fuel | LOX / bioLPG |

| Thrust | 30 kN |

Progress towards first Orbex Prime launch

When it comes to actual footage of the rocket or the engines in demonstration, we lack quite a few fundamentals. Orbex is quite shy about revealing technological progress publicly. The timeline of the maiden launch has been – as is usual with all newspace companies – delayed all the way from 2021 to probably more like 2024.

What can be used to gather a better view of where Orbex is at, one can look at the company’s fundamentals over the history:

- The company has, up until 2022, operated with less than 60 employees in 2 different factories. This is less than 40% of comparable companies such as Isar Aerospace, PLD Space, Skyrora or RFA.

- A lot of publicity is focussed on 1) green fuel, 2) the Sutherland spaceport, 3) funding rounds. There is very little public information regarding the vehicle, engine tests or structural integration.

- There is no public payload guide, no public pricing and still changing payload capabilities. Even after the vehicle reveal in May 2022 (a great PR event) key information remains private.

We believe that the team in Denmark is still very much in the development phase of the vehicle, and this extends towards the business side of things. Orbex also has a history of being very liberal with its funding numbers, employee count and PR, which brings us to funding, financing and pricing.

Orbex Funding and Valuation: A look at the financials of the rocket launch company

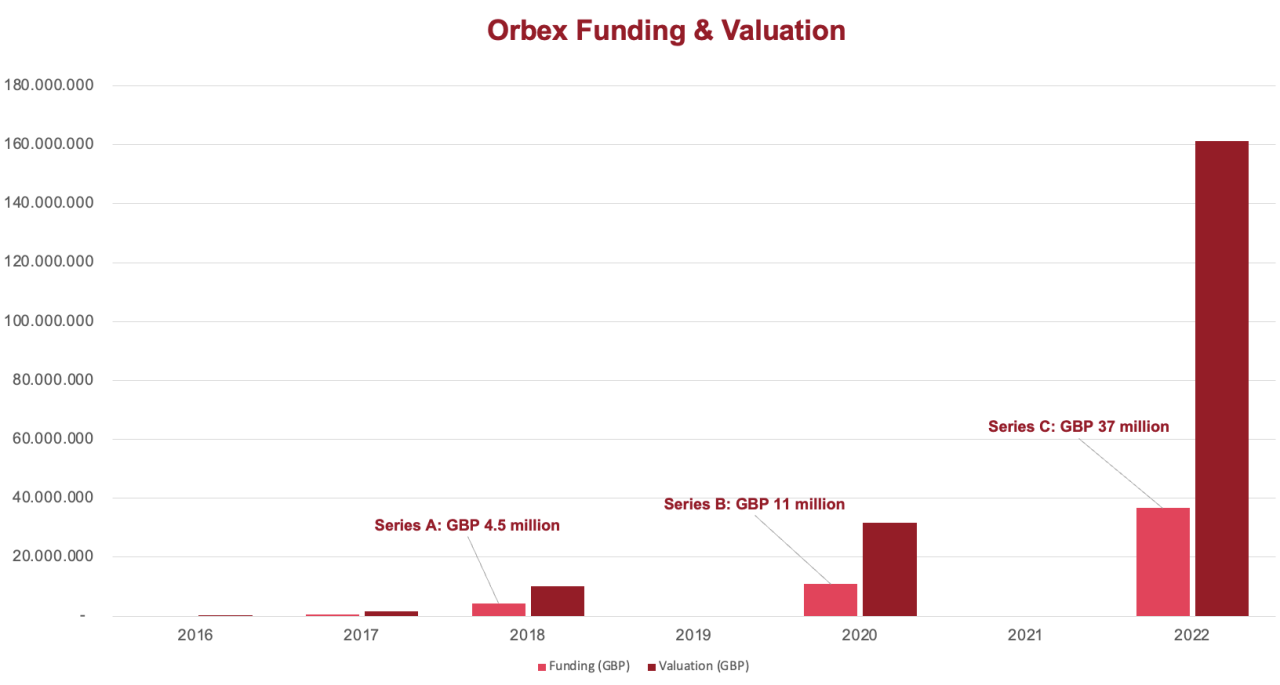

To find out Orbex’s Valuation and actual funding rounds, we had to dig a bit deeper and disregard a lot of the PR numbers that Orbex announced. Looking at the books of Orbex and their investors reveals that both the Series A and Series B rounds have been overstated by quite a lot.

The primary cash equity funding rounds and post money valuations so far have been, according to our calculations:

- 2015 and 2016: Smaller rounds and investments from business angels and founders

- 2017: Seed round between GBP 175,000 – GBP 450,000 (equity / convertibles)

- 2018: Series A, GBP 4.5 million at a GBP 10 million valuation

- 2020: Series B, GBP 11 million at a GBP 32 million valuation

- 2022: Series C, GBP 37 million at a GBP 160 million valuation

Orbex has generally included all of its grants, loans as well as implicit agreements for “equipment/assets/work investment” in their funding rounds, inflating the Series A in what they stated was “$40 million” in funding. This is hard to believe, especially considering the number of employees at the time, which was less than 15.

Orbex has also used USD, EUR and GBP for financing and announcements, making things even not quite so transparent – not necessarily on purpose, but maybe a reflection of the structural issue for UK-based company post-Brexit, who works with EU, UK and US corporates.

The actual cash Orbex has received on top of the equity rounds mentioned above, include at least:

- 2018: GBP 5.5 million from the UK Space Agency (grant)

- 2020: GBP 2 million from the European Horizon 2020 SME (grant)

- 2020: GBP 1.8 million through HIE (loans and grants)

- 2021: GBP 6.5 million from ESA Boost! program (grant)

That brings our total hard cash received by Orbex so far to around GBP 75 million. Projections of Larmour so far have been USD 100 million* for a functioning rocket, so the company could already have enough funding to get to operations.

Orbex business model and cost per kg: “Low cost” – but there has never been a price

We could not find any specifics regarding Orbex’s launch price per kg. We did find one reference to price by Larmour from June 2021, when he stated that: “We’re about a quarter of the cost of a rideshare”. To find out what exactly that means, we had to dig around quite a bit. First, let’s use a comparative approach:

Orbex has signed commercial launch contracts – among others – with 1) SSTL, 2) In-Space Missions (now BAE systems) and 3) TriSept Corporation.

- SSTL has launched from Ariane 5 and Soyuz recently. Both of these launchers are priced at around USD 20,000 per kg,

- In-Space Missions has flown on the (failed) Virgin Orbit in January 2023. Virgin Orbit charges about USD 40,000 per kg,

- TriSept has signed contracts with Relativity Space, who charge roughly USD 10,000 to USD 12,500 per kg.

Orbex, however, can offer a dedicated polar or sun synchronous orbit with up to 150 kg in payload mass. This gives them an advantage for pricing. What they also provide is a dedicated timeframe and orbit, which is of benefit for the payload customer. This is also what Larmour means by “quarter of the cost of a rideshare”: The price per kg is way higher (potentially around USD 60k to USD 80k), but the overall launch cost due to dedicated rides and orbits can save a lot of time and money for the payload customer.

Now, considering Orbex has been quite outgoing about sticking with their micro-launcher vehicle and business long-term, we will go ahead and benchmark the numbers. Our assumptions:

- Price tag of GBP 3.5 million to GBP 6.5 million per launch, averaging to GBP 5 million

- Orbex will need USD 100 million to get to operations (stated by Larmour)

- 150 employees, adding 50 per year (less than planned as stated by Larmour) at GBP 45,000 cost per person

- Up to 12 launches per year

- Rocket production cost of GBP 3 million (favorable assumption)

Orbex business plan: Favorable back of the napkin calculations for a micro launcher business

| Type | Investment | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 |

|---|---|---|---|---|---|---|---|---|---|

| Personnel | 150 | 200 | 250 | 300 | 300 | 300 | 300 | 300 | |

| Personnel Cost | -6,750 | -9,000 | -11,250 | -13,500 | -13,500 | -13,500 | -13,500 | -13,500 | |

| Launches | 1 | 2 | 4 | 8 | 12 | 12 | 12 | 12 | |

| Launch Revenue | 5,000 | 10,000 | 20,000 | 40,000 | 60,000 | 60,000 | 60,000 | 60,000 | |

| Launch Cost | -3,000 | -6,000 | -12,000 | -24,000 | -36,000 | -36,000 | -36,000 | -36,000 | |

| Bottom Line | -4,750 | -5,000 | -3,250 | 2,500 | 10,500 | 10,500 | 10,500 | 10,500 | |

| Break-Even | -75,000 | -79,750 | -84,750 | -88,000 | -85,500 | -75,000 | -64,500 | -54,000 | -43,500 |

In this best case scenario, with a very efficient 12 launches in 2027 at 300 employees (though Larmour has stated he is aiming for 400 employees in one factory alone), and a favorable launch price of GBP 5 million per launch (USD 6 million), Orbex is making around 10 million in profit per year by 2027.

Now, a few notes on the assumptions:

- We assume there is no competition, and in the micro-launcher class (<200kg) there are currently no other alternatives in Europe, so this could work until 2026, 2027.

- Orbex is managing Sutherland spaceport, so they have a competitive advantage for pricing cost. They could scale by going to other spaceports, so the number of launches at 12 per year could go higher. It has to be seen how fixed launch costs make their offering less attractive for payload buyers (launch costs from spaceports are probably between GBP 350,000 – GBP 1.5 million)

- Employee cost is quite favorable, and the number of employees is low. There probably will be higher revenue and higher costs for any modelling (we assume GBP 45k all-in, while Denmark’s employee costs were closer to GBP 90,000 per person so far)

- Overall risk of “reality”: Rocket Lab, with their small Electron vehicle (250 kg to LEO), after 30 launches, still operates with a negative launch margin.

Could Orbex operate like this? Theoretically, yes. Is it realistic? Let’s see.

Overview of signed commercial contracts

| Launch Partner | Payload | Signed in | Initial Launch Window |

|---|---|---|---|

| Surrey Satellite Technology (SSTL) | Experimental Payload | February 2019 | 2021 |

| Astrocast | Nanosatellites for IoT-Network | February 2019 | 2023 |

| In-Space Missions | Faraday-2b | August 2019 | 2022 |

| Innovative Space Logistics (ISL) | August 2019 | ||

| TriSept Corporation | January 2020 | 2022 |

My opinion on Orbital Express and why you should keep an eye on them

What I like about Orbex

- Great founder story: Larmour was 47 years old when he got the idea of the “Moonspike”. From what must’ve been a simple email exchange to Bengtson back in 2015, with enough curiosity, drive and persistence, they are now leading and running one of the largest newspace companies in Europe, trying to fulfill their dream of launching orbital rockets and redefining space for the EU and the UK.

- Copenhagen Suborbitals to Copenhagen Orbitals: Many of the engineers have a background at Copenhagen Suborbitals, a local amateur initiative to develop a (human) spaceflight program. It’s great to see how volunteer initiatives like this can help provide knowledge, information exchange and relationships to people interested in space – so far that it can become your life’s work.

What I don’t like about Orbex

- A microcosm of Europe’s flailing space ambitions: If we isolate the individual actions Orbex has undertaken over the years, it’s hard to see anything that seems unreasonable. However, if we put all the puzzle pieces together, Orbex seems to be a bit of a microcosm of the issues plaguing the European newspace ecosystem. These are:

- the lack of ambition and therefore a high risk of a dead-on-arrival business with a microlauncher designed for just 180 kg,

- working in a non-competitive environment, in which timelines and technological progress are all too often subordinate to PR, runway calculations and political involvement,

- chanting the shibboleths of eco-friendliness which distract media, government and the company itself from the core development: building a functioning rocket and getting stuff to space.

- Too much at the same time: Being politically locked in with Sutherland cannot be advantageous for the development of the rocket. Orbex got a big PR and business win with the spaceport, but this can only be a distraction when it comes on top of a vehicle in the intermediate stages of development.

Things to wach out for

- Cap table: There are currently 23 individuals or companies on the cap table, around 80% of the voting rights are in the hands of investors (including the government) and the articles of association are over 60 pages long. Orbex could already have enough funding and liquidity to achieve operations, though these are based on favorable assumptions. At the same time, the brains behind the rocket, which are primarily based in Denmark such as Bengtson, Bjarno, Nyboe and others, merely have 2% equity. This is quite an advanced shareholder structure for a company years out from regular launches.

- 3D-chess: If the rocket is not successful, Larmour has locked the company hard on Scotland and Sutherland. With Jacobs, the HIE, the Forres manufacturing hub and the overall UK space strategy, I’m making a wild prediction here: There is a chance that in 5 years time, Orbex will not be a launch provider but a spaceport manager. The Copenhagen office will be run as maintenance, Larmour will still be the CEO, and revenues will come from a variation of political and non-political space-related manufacturing efforts in Northern Scotland. Financial realities, shareholder votes and political capital can ensnare a company real quick. Let’s talk again in 2028.

*Editorial correction from January 31st 2023: We’ve corrected the funding amount required to get to operations from GBP 100 million to USD 100 million and also updated our calculations by removing the Series D. Orbex has claimed USD 100 million / GBP 85-90 million in November 2022, as well as USD 100 million in May 2022. We’ve also made updates to our business model calculations.

Update from April 2023: Chris Larmour stepping down as CEO of Orbex and Bengtson now taking over as interim CEO looks to be the result of many of the things that we initially published and commented on here. Currently, we do not have enough information how the company will proceed with Sutherland or the rocket development and we will closely monitor the situation. For now, we believe it makes sense to keep the article as is.

Further reading on Orbex:

- If you’re curious how everything started, you can check out Moonspike’s kickstarter or their original rocket design

- Read our report on the Sutherland Space Hub, which will be Orbex’s main spaceport

- Check out Copenhagen Suborbitals, Europe’s amateur rocket initiative with a human space program

- There’s also an interesting recording from a strategy seminar by Copenhagen Suborbitals from July 2014, held by Jonas Bjarnø, who is the brains behind anything flight related at Orbex (sadly in Danish, though slides in English)

Working at Orbex: Salary, job benefits and career opportunities

Orbex is one of the fastest growing new space companies in the UK and Europe. It is looking for dozens of positions, both for its office in Copenhagen as well as for its manufacturing hub in Scotland. Generally, engine and propulsion engineering is done in its Copenhagen office, while structural and vehicle manufacturing as well as business operations are done from their base in Forres, Scotland.

The salary at Orbex is generally decent and higher than at UK competitors such as Skyrora. Orbex also posts its salary ranges in most of its job ads, unless it is for leading positions where salary and compensation is heavily dependent on experience. The following compensation is to be expected. For engineers in the UK, such as electronics engineers or composite design engineers, salary will be between GBP 43,000 and as high as GBP 65,000. For composite technicians, software integration and test engineers, salary is between GBP 30,000 – GBP 45,000.

Key jobs in propulsion are in Copenhagen and have a much higher salary. Propulsion Design and Test Engineers can expect between GBP 42,000 to GBP 60,000 (converted from DKK), while Senior Propulsion Engineers can go as high as GBP 75,000 per year. An overview of several listings:

Salary overview at Orbex

| Position | Salary per year | Location |

|---|---|---|

| Software Integration / Test Engineer | GBP 30,000 – GBP 37,000 | Forres, Scotland |

| Electronics Engineer | GBP 45,000 – GBP 61,900 | Forres, Scotland |

| Senior Electronics Engineer | GBP 43,000 – GBP 66,000 | Forres, Scotland |

| Composite Technician | GBP 30,000 – GBP 45,000 | Forres, Scotland |

| Composite Design Engineer | GBP 46,000 – GBP 62,000 | Forres, Scotland |

| Tax & Treasury Analyst | GBP 40,000 – GBP 45,000 | Forres, Scotland |

| Buyer’s Assistant | GBP 25,000 – GBP 32,000 | Forres, Scotland |

| Propulsion Design & Test Engineer | GBP 42,000 – GBP 60,000 | Copenhagen, Denmark |

| Propulsion Test Lead | GBP 60,000 – GBP 75,000 | Copenhagen, Denmark |

| Senior Propulsion Engineer | GBP 60,000 – GBP 75,000 | Copenhagen, Denmark |

More information on Orbital Express Launch Ltd. (Orbex)

| Type | Information |

|---|---|

| Official Company Name | Orbital Express Launch Ltd. |

| Founded in | May 2015 |

| Management | Kristian von Bengtson, Jimmy Nielsen, Keith Barclay (non-executive), Alexander Gonzalez (non-executive), Joseph Markus (non-executive), Simon Paul King (non-executive), |

| Founding Members | Christopher Larmour, Kristian von Bengtson, Jonas Baekby Bjarnoe, Steen Andersen and Flemming Nyboe |

| Locations | |

| Headquarter | Orbex Forres, 6 Innovation Way, Forres Enterprise Park, Forres IV36 2AB, United Kingdom |

| Subsidiary | Orbital Express Launch ApS, Kanalholmen 14a, 12650 Hvidovre, Copenhagen, Denmark |

| Subsidiary | Orbital Express Launch UG, Destouchesstr. 48, 80803 Munich, Germany |

| Launch Site | Sutherland Space Hub |

| Contact | |

| Website | Orbex Website |

| Orbex Instagram | |

| Orbex Twitter | |

| Orbex LinkedIn |

Interested in new space? Read more in-depth reviews and analysis

- Top 10 European Space Launch Companies 2024The European Space and Rocket Companies to watch out for in 2024 As we move into 2024, the landscape of space exploration and satellite deployment is increasingly dominated by a group of 10 European space launch companies. These startups and established companies are trying to push the boundaries of European-made… Read more: Top 10 European Space Launch Companies 2024

- 2024 Update on HyImpulse Tech🔥 Our 2024 HyImpulse update: Riddle me this – Launching from Australia The Germans plan a rocket launch. They need a spaceport. There are 2 freshly opened ports in Scandinavia. You have a contract with a third in the UK and a letter of intent with a fourth at home.… Read more: 2024 Update on HyImpulse Tech

- 2024 Update on PLD SpaceOur 2024 Update for PLD Space: The emperor has no clothes Company statements and balance sheets are a record of a management’s competence and truthfulness. Over the past decade, PLD’s management has proven deficient in both. Investment rounds, project schedules or launch capabilities: The history of PLD is marred by… Read more: 2024 Update on PLD Space

- PLD SpacePLD Space is a Spanish NewSpace company building the MIURA rockets. It was established in 2011 with the goal of providing the first commercial launch services for Spain and from Spain.

- Rocket Factory AugsburgRocket Factory Augsburg (RFA) is a new space company established in 2018. RFA is well funded and aims to beat competitors on cadence and pricing. The company plans to offer payloads of up to 1,300 kg at a cost of $3,000 to $4,000 per kg.