Welcome to our in-depth analysis of Rocket Factory Augsburg, initially published on January 11th 2023 and most recently updated August 2024 (highlighted in blue). Make sure to check out our mission statement and why we do what we do. Look at our New Space guide if you want explanations of terms and concepts used in our research. And follow us on Twitter for updates.

What you should know about RFA: Rocket Factory Augsburg

📰 For space enthusiasts

- Development and production of RFA One rocket with 1,300 kg LEO payload capacity

- Helix engine with 100 kN of thrust, 325s Isp (SL), based on KeroLOX

- Unique Orbital Transfer Vehicle (OTV) “Redshift” for in-orbit services such as refueling, energy supply, constellation management, powered by Fenix engine

- Only new space provider offering access to cis-lunar space (with OTV)

- Super low base price $3,000 per kg to orbit

- Successful upper stage hot fire test in May 2023

- First launch planned Q2/2024 from SaxaVord Spaceport

- Sourcing many non-critical components from German automotive industry, thus leveraging mass market-approach to build rockets “like cars”

💰 For VCs and industry experts

- One of Germany’s hottest rocket company with institutional backing from OHB SE, a leading German aerospace and defense company

- Prominent political capital through OHB and MT Aerospace, former ESA chief Jean-Jacques Dordain, former DLR chief Wolfgang Koschel

- Company valuation at around EUR 240 million

- Received EUR 30 million debt convertible from investment giant KKR in August 2023

- Trying to disrupt the industry with super-low cost pricing ($3,000 per kg to LEO), $3 Mio launch price for 1,300 kg to space

- $50 mio in signed contracts (ESA and commercial contracts), prospective $500 mio in revenue

👨💻 For potential employees

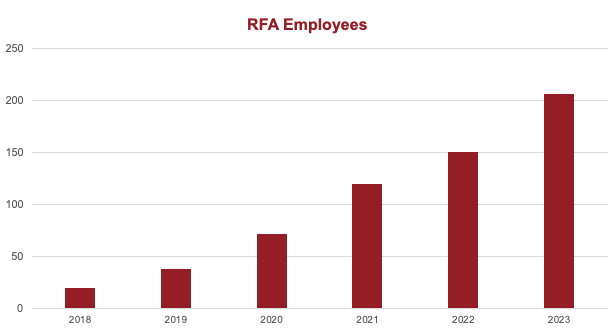

- One of the fastest growing rocket companies in Europe with over 50 open positions

- 200+ employees, 35+ countries, building technology in Germany, Portugal, Scotland and Scandinavia

- Seeking hardware and software engineers, material and structural designers, GNC (guidance, navigation and control) personnel, launch operators and business operations

- Good salary, engineers with around EUR 50,000 to EUR 75,000. Stock options possible

- Best community engagement, merchandise and swag in Europe

Rocket Factory Augsburg: How RFA became one of Germany’s leading rocket companies

Rocket Factory Augsburg (RFA) is a new space company that was established in 2018 as a spin-off of OHB SE by Jörn Spurmann, Stefan Brieschenk, Hans Steiniger, and Marco Fuchs. These individuals, along with Dr. Stefan Tweraser (who joined RFA as CEO in October 2021) and Jean-Jacques Dordain (Chairman), make up the company’s Board of Directors.

Rocket Factory Augsburg (RFA) has developed a business strategy that aims to beat competitors on cadence and pricing. The company plans to offer payloads of up to 1,300 kg at a base cost of $3,000 to $4,000 per kg, while launching approximately 50 times per year to dedicated orbits for full satellite constellations by 2030. RFA uses a variable pricing model, where customers pick services for their flight on a “base model”, so pricing will only start at $3,000 but certainly be quite a bit higher in reality.

In addition to its low cost pricing, RFA is also focusing on in-orbit services, using the “Redshift” third orbital stage that enables satellite and constellation-management in-orbit. Running as the “Uber for the price of a bus ticket”, RFA wants to make LEO more accessible by offering servicing, refueling and end-of-live services to its partners.

RFA moved to its new 5,000 square meter headquarters in Augsburg in March 2021 and currently employs more than 200 people from over 35 countries.

RFAs Rockets: RFA One and the “Helix” engine

RFA is developing the RFA One rocket, with two more rockets being rumoured or in development stages by RFA. The first rocket is the RFA One, which is a three-stage kerosene and liquid-oxygen (KeroLOX) vehicle. It has has a diameter of 2 meters and a length of 30 meters. The first two stages are powered by 9+1 Helix engines (KeroLOX) plus a third orbital stage with a unique propellant based on nitromethane. The vehicle has a maximum payload capacity of 1300 kg for launch into 500 km SSO (sun-synchronous orbit).

RFA’s Helix engine uses kerosene and liquid oxygen for propulsion. It uses oxygen-rich staged combustion as its propulsion system, rather than gas-generator cycles. This means that the rocket’s turbo pump is driven by oxygen-rich gas, which is then injected into the main chamber and mixed with the remaining fuel to complete the combustion process. The use of oxygen-rich staged combustion allows for a cleaner burn and improved efficiency compared to gas-generator cycles.

The rumoured vehicles include the RFA One Reusable. The reusable version was non-publicly presented as early as February 2021. The reusable RFA One is quite similar to the RFA One in terms of diameter, though 10 meters longer at 42 meters height. It would use 17 Helix engines on the first stage. In its reusable configuration, it could have a maximum payload capacity of 1,300 kg to SSO. However, if it is made expendable, it could have a maximum payload capacity of 2,300 kg.

There is also a third rocket, larger rocket in development, known as the RFA One Max. The RFA One Max was confirmed at the 15th European Space Conference in January 2023. The RFA One Max is a larger vehicle that is said to have another ring of Helix engines on the first stage, significantly increasing its thrust. It has a capacity of 700 kg to MEO (medium-earth-orbit). More details about this rocket are currently scarce, as it has not yet been officially confirmed by RFA.

What makes Rocket Factory Augsburg’s services unique

RFA has basically grouped its strategy and service offering into three clusters:

- RFA uses a lot of off-the-shelf components. This means that they are not planning on going for a full “vertical integration” approach such as Isar Aerospace, but they’d rather focus on low cost (scalable) production and their orbital services. Through this approach, RFA sources roughly 40% of its components from specialized (additive) manufacturing providers, many of which come from the automotive and manufacturing industry that is prevalent in southern Germany.

- Rocket Factory Augsburg has developed a propulsion system cluster that utilizes advanced staged-combustion technology to deliver high performance at a cost-efficient price point. This technology has, as RFA themselves called it, been “SpaceX proven” and RFA is the only company in Western Europe to implement it. As opposed to many structural parts, rocket engine design is, we believe, done fully in-house by RFA.

- RFA’s proprietary Orbital Transfer Vehicle (OTV) “Redshift“, technically a third stage, is a unique feature of their approach to launching payloads into space. This stage is capable of delivering payloads of up to 1,300 kg to LEO and positioning whole satellite constellations in their final orbits. These services are intended to be similar to the “AAA for satellites,” providing customers with a range of services such as satellite inspection via a diagnosis device, refueling with fluids and gases, Dock&Steer Attitude and Orbit Control System (AOCS), energy supply, end of life management, and asset monitoring. These services could potentially make it easier for organizations to operate and maintain their satellites, while also helping to address the issue of space debris. The use of this stage allows RFA to offer a differentiated service to their customers by offering the ability to place satellites in specific orbits as part of a launch package.

| Orbit | Redshift Payload Capability |

|---|---|

| Low Earth Orbit (LEO), Sun-Synchronous Orbit (SSO), up to 500 km | 1.300 kg |

| Polar Orbit, up to 2.000 km | 850 kg |

| Medium Earth Orbit (MEO), up to 6.000 km | 500 kg |

| Geostationary Transfer Orbit (GEO) | 450 kg |

| Cis-Lunar | 150 kg |

With this three-pronged approach, RFA has developed a business strategy that aims to beat competitors on cadence and pricing. The company plans to offer payloads of up to 1,300 kg at a cost of $3,000 to $4,000 per kg, while launching approximately 50 times per year to dedicated orbits for full satellite constellations. This sets RFA apart from competitors, as it offers dedicated orbits at a low cost and the ability to send full satellite constellations to space.

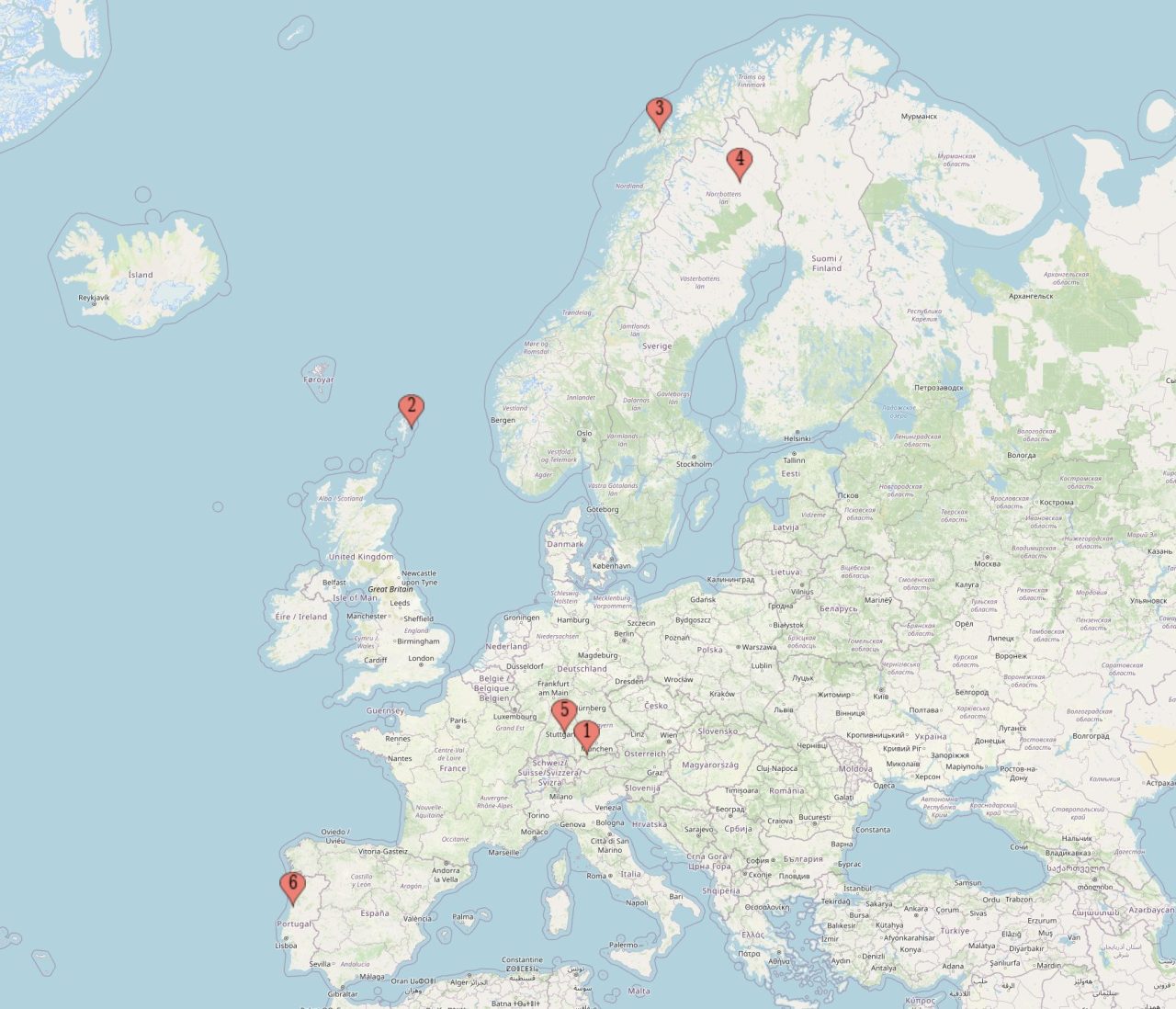

A truly international rocket company: RFA’s global footprint

RFA currently has its headquarters in the city of Augsburg (hence its name). It also makes use of the DLR test site in Lampoldshausen, which is not too far from its headquarter.

In January 2023, it was officially announced that RFA will be using SaxaVord Spaceport in Scotland as its primary launch port. It has secured launch pad Fredo for exclusive use and will also invest a “double-digit” in GBP million. As of May 2023, this was around 13 million Euros for the launch stool and other infrastructure. Meanwhile, RFA has also been in touch with 1) Southern Launch, a spaceport provider in Australia, 2) with the spaceport in the Azores, Portugal and 3) Andoya Space Center in Norway. While Andoya has been progressing recently and RFA could use the Norwegian launch site for its rocket, this does not seem likely considering they opened a British subsidiary in November 2022 named “Rocket Factory Ltd.”. We assume that SaxaVord will be the primary entity and launch spot.

The location in Portugal is a subsidiary in which RFA develops the Redshift orbital transfer vehicle together with the Portuguese space agency (ANI).

Major milestones of Rocket Factory Augsburg so far

| Date | Milestone |

|---|---|

| August 2018 | Founding of Rocket Factory Augsburg |

| June 2019 | First successful test of RFA turbo pump |

| October 2019 | Completion and qualification of 2nd stage tank |

| January 2020 | First fire test of the orbital stage engine |

| September 2020 | Test infrastructure and completion of engine prototype |

| February 2021 | New 5000 square meter facility with 100+ employees |

| May 2021 | Executing main engine test campaign |

| August 2021 | 1st demonstrator and burst test of core stage |

| October 2021 | New CEO Stefan Tweraser appointed |

| April 2022 | EUR 11 million grant from DLR micro launcher competition |

| July 2022 | Successful hot fire of Helix engine for 40 seconds |

| January 2023 | Strategic partnership with SaxaVord Spaceport as primary launch site |

| August 2023 | EUR 30 million in funding through debt convertible from KKR (“Series B”) |

Rocket Factory Augsburg: Funding and valuation of RFA over the years

RFA was originally founded in 2018 as a Rocket Factory Augsburg GmbH, a limited liability company, by MT Aerospace Holding GmbH – itself backed by OHB SE, one of the largest aerospace companies in Germany – and Jean-Jacques Dordain, the former head of ESA. RFA was then transformed into a stock company – Rocket Factory Augsburg AG – in 2019. MT Aerospace Holding GmbH itself is funded by MT Aerospace and Apollo Capital Partners GmbH, a small investment vehicle used by the MT Aerospace CEO Hans Steininger.

RFA has expanded quickly with the help of internal funding from OHB over the years, utilizing a share structure which offers some better options for funding than limited liability structures that for example Isar Aerospace uses. Over the years, OHB and MT Aerospace have remained the primary shareholder, with Jean-Jacques Dordain remaining one of the larger non-executive shareholders. The management, which is made up of Jörn Spurmann and Stefan Brieschenk, hold roughly 10% of the shares combined. Employees own another 5-10% of the company shares by our estimate, while Jean-Jacques Dordain also remains on the supervisory board of RFA. Smaller investors are now using the debt convertibles to gain access to RFA shares, such as Kalodion Fonds.

| Shareholder | % of shares |

|---|---|

| OHB SE (directly and indirectly through 70% shares in MT Aerospace Holding GmbH) | 60% |

| Apollo Capital Partners GmbH (indirectly through 30% shares in MT Aerospace Holding GmbH) | 20% |

| Jean-Jacques Dordain | 4% |

| Management and Employees | 16% |

| Potential Changes: KKR might be able to obtain 25% through their August 2023 funding round (3.3 million shares) |

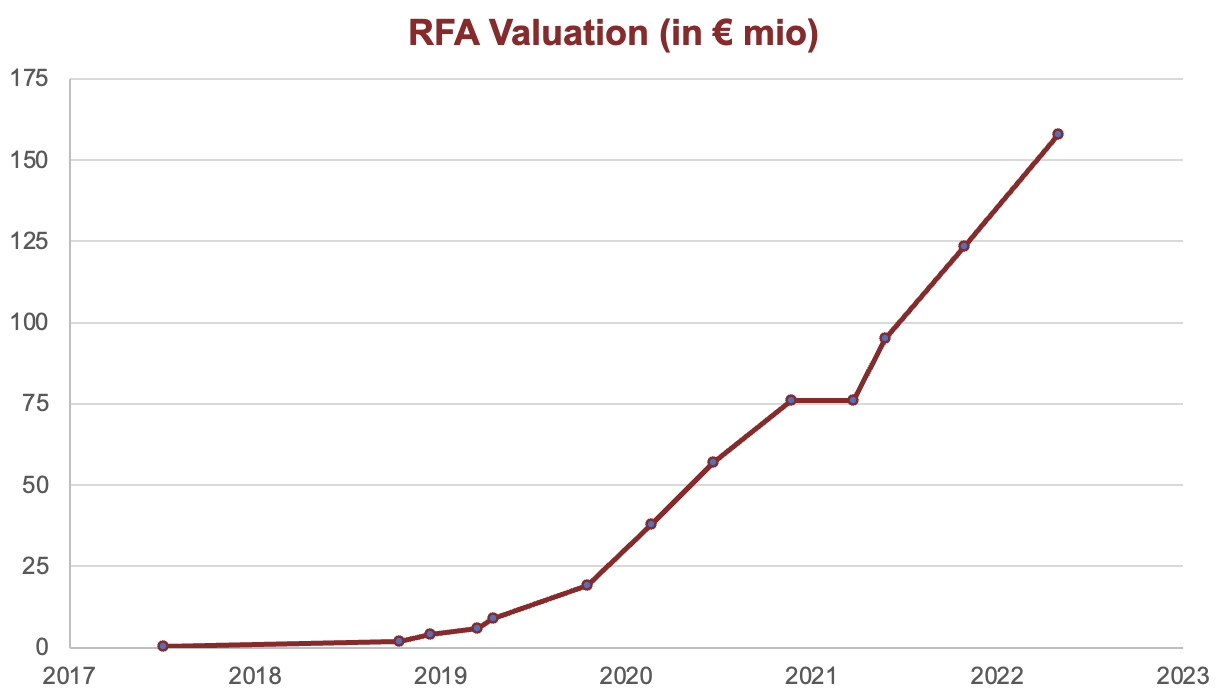

We have used public company data and company announcements to estimate the company’s funding efforts and valuation. We have to note that we used the “valuation” only in relation to the options price of the convertible bonds that were issued (“Wandelschuldverschreibung“), though according to the statutes, this is the price the shares have to be traded at over-the-counter as well.

In terms of debt funding, as of May 2023, RFA has raised a total of EUR 25,960,000 through debt convertibles. The bonds yield around 2.75% to 3% per year with a duration of 4 or 5 years and a convertible price indicated as “share price” in our table. Using the conversion prices offered over the years by the debt issuance, we can estimate the valuation of Rocket Factory Augsburg at currently around EUR 160 million. The funding and valuation of the company as follows:

| Date | Total Shares | New shares | Convertible Shares | Share Price | Valuation |

|---|---|---|---|---|---|

| 07/2018 | 500,000 | 1,- € | 500,000 € | ||

| 10/2019 | 2,000,000 | 1,500,000 | 1,- € | 2,000,000 € | |

| 12/2019 | 4,000,000 | 2,000,000 | 1,- € | 4,000,000 € | |

| 03/2020 | 6,000,000 | 2,000,000 | 1,- € | 6,000,000 € | |

| 04/2020 | 9,000,000 | 3,000,000 | 1,- € | 9,000,000 € | |

| 10/2020 | 9,500,000 | 500,000 | 2,- € | 19,000,000 € | |

| 02/2021 | 9,500,000 | 500,000 | 4,- € | 38,000,000 € | |

| 06/2021 | 9,500,000 | 500,000 | 6,- € | 57,000,000 € | |

| 11/2021 | 9,500,000 | 500,000 | 8,- € | 76,000,000 € | |

| 03/2022 | 9,500,000 | 300,000 | 8,- € | 76,000,000 € | |

| 05/2022 | 9,500,000 | 360,000 | 10,- € | 95,000,000 € | |

| 10/2022 | 9,500,000 | 320,000 | 13,- € | 123,500,000 € | |

| 12/2022 | 10,544,848 | 1,044,848 | Converted shares | ||

| 04/2023 | 10,544,848 | 320,000 | 15,- € | 158,172,720 € | |

| 05/2023 | 11,830,467 | 1,285,619 | Converted shares | ||

| 08/2023 | Up to 3,262,654 EUR conditional share capital | ||||

| 09/2023 | 11,830,467 | 590,980 | 15,- € | 177,457,005 € | |

| 09/2023 | 11,830,467 | 1,000,000 | 15,- € | 177,457,005 € | |

| 12/2023 | 12,230,027 | 399,560 | Authorized capital: 6,115,013 | ||

| 01/2024 | 12,230,027 | 1,000,000 | 15,- € | 183,450,405 € |

We believe that OHB has been funding RFA over the last years by buying convertible debt, so they have call options on outstanding shares. As of December 2021, OHB had invested at least EUR 7.5 million into RFA. It is further worth considering that roughly 80% of the shares are in the hands of OHB or OHB related entities, which makes it clear that RFA will not be a candidate for venture capital. In December 2022, OHB has initiated a program to acquire outside investment into RFA, according to their (OHB’s) annual report.

New insights became clear in May 2023, when

- OHB’s 2023 Q1 report announced that they are giving up its strategic position in RFA. According to OHB’s quarterly report, they have relinquished control over Rocket Factory Augsburg due to a voting rights agreement, leading to the deconsolidation of RFA from OHB’s financial statements, with future assessments to be made on an at-equity basis

- Looking at RFA’s annual report of 2021, RFA is trying to close a EUR 30 million Series B with a strategic investor “at the end of 2022 or the beginning of 2023”. In April 2023 they opted for another € 4.8 million of debt and converted over 1 million shares from previous debt convertibles. We assume that these were both moves to clear up the shareholder register and as a precautionary measure until they close the Series B.

RFA still requires a medium 8-figure amount to get to operations. The first convertible bonds will also become due during 2023 and 2024, putting further financing pressure on the company.

With another update from August 2023, RFA has announced the closure of a EUR 30 million Series B funding round using another debt convertible model. The funding, which was subscribed by investment giant KKR, is a very positive signal and came just weeks after RFA’s successful upper stage hot fire test.

The board now has the option to issue up to 3,262,650 more shares – presumably to KKR – which would give KKR a (direct) minority stake of just over 25%. Interestingly enough, the funding round was filed with the German commercial register originally with over 4.500.000 potential new shares but decreased to the aforementioned 3.3 million. One possible interpretation could be an increase in valuation after successful tests (issuing less shares for the same amount of money – the EUR 30 million that was announced in 2021 already), though the initial board meeting from June 28th 2023 was already held after the test.

In terms of the most recent valuation for RFA, we haven’t seen any convertible prices for the debt, though Financial Times reported the valuation was at EUR 240 million (while OHB’s was at around EUR 1 billion). This would be a considerable increase and, considering the funding environment, a huge success for RFA.

As for the actual cash-flows from KKR, the first funds went to RFA via convertibles of 8.8 million and 15 million Euros in September 2023 and another 15 million in January 2024, all with a new and higher coupon of 5% per year. Interestingly enough, this means that almost 40 million Euros have flown to RFA since the funding round – as opposed to the 30 million Euros. Furthermore, RFA’s board still can issue another convertible for the remaining 675,000 issuable shares, which – at current valuation – could yield another 12,5 million Euros.

These facts were generally confirmed in RFAs 2022 annual report.

Rocket Factory Augsburg: Contracts, revenue and business model

RFA positions itself as a “service of an Uber for the price of a bus” with 3 main goals:

- “Lowest cost” through industrialized rocket engine production and a focus on reusability, standard industrial parts and highly efficient production technologies

- “Last mile delivery” with orbital stage that can precisely position up to 100 satellites and whole constellations with a single launch

- “Space Services” which include servicing satellites, constellation replenishment and refueling and space debris removal

The company has already secured $47 million in signed contracts, with $60 million in the quotation process and $90 million in requests for information sent out. Additionally, RFA has signed letters of intent (LOIs) with its parent company OHB worth approximately $128 million and has approximately $300 million in prospects. Among its signed contracts are $16 million in institutional contracts with the European Space Agency (ESA) and Portugal’s space agency (ANI), as well as $31 million in launch service contracts with companies including Plus Ultra, Lunar Research Service (LRS), Neutron Star Systems, Sener Aerospacial, and OHB Cosmos.

In April 2022, RFA won the second round of the “DLR micro launcher competition,” which includes a contract to launch 150 kg for the German Aerospace Center (DLR) on the first two RFA One flights, as well as EUR 11 million in funding to further develop its launch vehicle.

Rocket Factory Augsburg: Salary, benefits and working at RFA

RFA has by now a team of over 200 people in different locations, including Germany, a small subsidiary in Portugal as well as individual locations for testing in Sweden (ESRANGE) and for launching in Scotland (SaxaVord) as well as Norway (Andoya). RFA focusses heavily on students and internships, with around a third of the team made up of interns and students at the end of 2021. Generally, the company operates in English, so there are no German skills required, although they might be beneficial.

Company Structure: How RFA is set up internally

RFA’s company structure is made up of 6 core technical and engineering departments which are responsible for the rocket development. These are:

- Propulsion (a rocket needs an engine)

- Structures (engine needs propellants and a proper structure)

- Launch (rockets have to take off, preferably without exploding)

- Avionics (they also have to fly)

- GNC (once they fly, you want to control where)

- Production (did it work? now let’s produce hundreds of them)

Then, of course, you have the traditional internal departments such as HR, IT, Finance and Sales. What seems to be the most interesting department at RFA could just be the “Special Projects Rocketry / Project Department”:

Introducing RFA’s “Special-Projects Rocketry Team”

If you’re hearing a lot of amazing things coming out of RFA, particularly rumors what they’re working on or developing, it might just be the work of the “Special-Projects Rocketry Team” (SPRT). In the words of RFA, the SPRT is

“a dedicated, dynamic and international environment that aims for excellence by creating high-performance engineering solutions while keeping prototyping and production costs at an absolute minimum.“

Now this is not “officially” a thing but can be found in several job ads. We believe that the SPRT is basically RFA’s – and by extension OHB’s – internal task force that specifically looks at potential future space technology, new ways of operation and production of rockets and everything “NewSpace” with a first principal approach. With this task force, RFA is for one looking at the future to see where the space industry is headed, but also analyses how it could implement potential findings into its own production stream.

Jobs include roles such as “Predevelopment Engineer Future Space Technologies”, “Avionics Technical Project Manager”, “Predevelopment Engineer Vehicle Design” and many others. Quite interesting and so far not something we have found at any other NewSpace company.

Salary and benefits at RFA

The salary at RFA is dependent on your position, education and experience. Since RFA is an indirect subsidiary of MT Aerospace as well as OHB systems, the salary structure and ranges are pretty good and won’t be too low, as is usually the case in externally funded startups. For engineers, we estimate salary ranges from EUR 55,000 to EUR 75,000 depending on experience. Business administration should range between EUR 40,000 to EUR 50,000. As of 2021, there were no bonuses (christmas, vacation) which is standard for larger corporates in Germany, though the absence of bonuses can expected for a startup in its early years. Overtime is probably only paid in accordance with local laws, which generally allow you to work 20 hours extra per month without further pay.

As a young company, RFA offers share participation (VSOP/ESOP) and gives leading members of the team a direct participation through shares and stock options. As per our estimate, around 5 – 15% of the shares are currently held by employees of the company.

We expect salary at RFA to be a bit lower than salary at Isar Aerospace, simply due to the fact that the living costs in Augsburg are much lower than the living costs in Munich for Isar’s employees.

Tools in use and skills you should bring if you want to work at Rocket Factory Augsburg

In case you’re interested in working at RFA, at any point in time over the last 2 years, there have been over 50 open positions. In 2021 for example, there were approximately 600 applications and 75 interviews per month, and a total of 50 interns, 10 working students and 75 fixed employees in the company. RFA also wants to double the team size until 2024 to about 300. To help you a bit and make you understand which tools and skills are required, we’ve aggregated some of the things that RFA is in need of, structured by department:

| Department | Knowledge & Tools required | Potential Jobs |

|---|---|---|

| Propulsion | – CAD Software, particularly Siemens NX – LabVIEW for production system development, validation and testing – Knowledge of thermodynamics, thermochemistry, mechanics, pressurized components – Experience with liquid rocket engines, sensors, hands-on experience with com | – Orbital Stage Propulsion / Development Engineer – Propulsion Production Engineer – Intern / Working Student Propulsion Test Data Engineer |

| Avionics | – LabVIEW for production system development, validation and testing – PCB design work, RIO mezzanine card / FPGA interfacing – Electronmechanical work (actuators, BLDC motor driver circuits), experience with communication buses (CAN, Ethernet, SPI, RS422) – Project Management: Gantt Chart, Wrike, MS Project Experience | – Avionics Technical Project Manager – Electrical Design Engineer – Mechatronic Engineer – Electrical Technician – Avionics Hardware Design Engineer |

| Launch | – CAD Software, particularly Siemens NX – MATLAB, Python, Simulink, C++ – Familiarity with structural engineering codes (Eurocode, ISO, ASTME, ASME, Machine Directive), Safety Standards (HAZOP, Safety In Design) – Experience of working with fluids, knowledge of fluid dynamics analysis, CONOPS – Numerical / analytical calculations for structural analysis (FEA, Ansys) – Project Management: Gantt Chart, PERT, WBS | – Senior Mechanical Design Engineer Launch – Ground Systems Engineer – Launch Licensing Engineer – Senior Flight Safety Engineer – Project Manager Launch |

| GNC | – MATLAB, Python, Simulink, C++ – Working with Git (GitLab) (currently mostly internships available) | – Ascent Guidance Engineer – Intern / Working Student Guidance, Navigation and Control and Flight Dynamics – Intern / Working Student Thrust Vector Control Algorithm Development |

| Structures | – Siemens NX – Experience working with machines such as Siemens 840D Heidenhain TNC 426 – Structural Analysis Software like Femap/Ansys, NASTRAN – MATLAB, Python | – CNC Operator – NX Designer – PLM Administrator |

| Production | – Siemens NX – Hypermill for CAM programming – Manufacture of assembled and welded constructions – Manual and machine processing techniques | – Construction Mechanic – Machinist – Aircraft Mechanic, Assembly Technician – Additive Manufacturing Technician / 3D Metal Printing – Welder – CNC / CAM Programmer |

| IT (in-house) | – Git and Docker – Python, JavaScript and Linux – Office 365, Azure Active Directory, Microsoft cloud app security Azure Information Protection, IRM – Intune (Conditional Access / MDM), Microsoft Enterprise Mobility + Security | – Software Engineer – Intern / Working Student Information Security – Intern / Working Student IT |

My opinion on Rocket Factory Augsburg and why you should keep an eye on them

What I like about RFA

- Producing rockets like cars: Mass manufacturing is required for mass migration to outer space, so using a very first-principle inspired approach seems promising. RFA probably also comes at an opportune time for many manufacturing companies and car-suppliers in southern Germany, who have to adapt their business model massively due to the introduction of electronic vehicles. When RFA asks for specialized serivces for combustion engines (such as rockets), these companies are probably welcoming them with open arms.

- Space services, and in-orbit servicing: RFA makes LEO seem much more relatable and close. The “third stage” could be a game-changer in services provided to commercial, governmental and military institutions. The variable pricing model is also interesting, in which orbital serivces can be included, but are not necessary for every payload purchaser.

- Outgoing and transparent: RFA’s PR game has been pretty good and they have been quite transparent about their progress. Several podcasts from the management and engineers show the passion the team has for the company, its products and its rocket.

What I don’t like about RFA

- Heavy political capital: Some might put this into the “what we like” bracket, but I believe that heavy political capital can slow down developing and really moving the company and technology forward long-term, especially once the rockets succeed and steady revenues through governmental/ESA contracts might even disincentivize capital-intense developments (i.e. reusability, medium or heavy-payload vehicles). (Update August 2023: With KKRs investment into not just RFA but also OHB, planning to take it private, this obviously means increased focus on commercialization and a rapid changes in company strategy, which we take as an overall good sign.)

- Not founder-led: The company is an extension of OHB SE and MT Aerospace, two rather large aerospace and defense companies. While the management team is incentivized through shares (owning around 5 – 10% of the shares by our estimates), it feels a bit different from a founder-led startup company.

Things to watch out for

- RFA One MAX, RFA One Reusable: We’re quite curious about the so far unannounced but rumored RFA One Max rocket engine which should bring more launch capability to the company and possibly a commercial, medium-class rocket onto the European continent. There have also been words of reusability, though considering strategic issues (where would you reland in Europe currently?) this is probably still years off.

Want to know more about Rocket Factory Augsburg? Here are some tips:

- RFA’s COO and chief engineer Stefan Brieschenk has done a great podcast with NASA Spaceflight that is definitely worth checking out to know more about the rocket

- RFA’s CCO (chief commercial officer) Jörn Spurmann has done an episode with Mars Chroniken on their commercial efforts and current status in February 2023 (in German)

Updates on Rocket Factory Augsburg

With our larger update from May 2023 we have included information from RFA’s 2021 annual report, which was released on May 17th 2023. We’ve also included information from Frank Strang, CEO of SaxaVord Spaceport that was publiziced in a UK government hearing. Further points:

- New funding round (debt convertible) in April 2023, valuing the company at around EUR 160,000,000

- The overall transition from OHB to a new strategic investor in their Series B, which RFA has been trying to close since end of 2022

- Updated information on the Redshift OTV

- Including the second Portuguese subsidiary in the Azores

Our update from August 2023 covers the new funding round from KKR over EUR 30,000,000 as well as the new launch date, which was postponed from Q4/2023 to Q2/2024.

Structured company information on Rocket Factory Augsburg AG

| Type | Information |

|---|---|

| Official Company Name | Rocket Factory Augsburg AG |

| Founded in | July 2018 |

| Management | Stefan Tweraser, Stefan Brieschenk, Jörn Spurmann |

| Founding Investors | MT Aerospace Holding GmbH (90%) Jean-Jacques Dordain (10%), ex ESA Director General |

| Locations | |

| Headquarter | Berliner Allee 65, 86153 Augsburg, Germany |

| Primary Launch Site | SaxaVord Spacesport, Haroldswick, Unst, Shetland Island, Scotland |

| Secondary Launch Site | Andøya Space Center, Norway |

| Test Site | Esrange Space Center, Sweden |

| Test site | Lampoldshausen, Germany |

| Subsidiary | Av. Dom Afonso Henriques 1825, 4450-017 Matosinhos, Portugal |

| Subsidiary | RFA Azores Unipessoal Lda., Angra do Heroismo, Azores |

| Subsidiary | Rocket Factory Ltd., 15 Castle Road, Grantown-On-Spey, Scotland PH26 3HN |

| Contact | |

| info@rfa.space | |

| Website | https://www.rfa.space |

| RFA Instagram | |

| RFA Twitter | |

| RFA LinkedIn | |

| YouTube | RFA Youtube |

Interested in more space companies? Read our other reviews and analysis

- HyImpulse TechnologiesWelcome to our in-depth analysis of HyImpulse Technologies, originally published December 15th, 2022 and most recently updated in March 2024 (highlighted in blue). Make sure to check out our mission statement and why we do what we do. Look at our New Space guide if you want explanations of terms… Read more: HyImpulse Technologies

- Andøya Space CenterThe Andøya Space Center is a spaceport made for launching rockets in northen Norway. It is a remarkable and historic place that you probably have not heard of. With a history of rocket launches dating back to 1962, it is one of the oldest active launch sites in the world. Its location in northern Norway at a latitude of 69° makes it also the northernmost launch site in the world. Now, Andøya Space Center (ASC) will become the first of its kind on the European continent with a new launch site for orbital launches.

- SkyroraSkyrora is a NewSpace company based in Scotland that develops the Skyrora XL, a three-stage liquid propulsion rocket for payloads of 315 kg into low-earth-orbit. Read our insights and analysis of Skyrora

- OrbexOrbex is a European rocket startup developing the Orbex Prime rocket. The Orbex Prime will be a microlauncher with potential payloads of up to 150 kilogram to low earth orbit (LEO). Orbex is truly a European new-space startup, though it considers itself UK-based for strategic reasons.

- LatitudeLatitude (formerly Venture Orbital Systems) is a French new space company developing the Zephyr rocket. Latitude wants to compete in the micro launcher market with its Zephyr rocket. Find out more on the history, business, financials and strategy behind Latitude